wcs oil price ,wcs oil price forecast,wcs oil price, Get access to our self-serve database of oil and gas prices, Cdn/US energy statistics and operating metrics for key oil sands facilities. $60.00

Introduction:

Western Canadian Select (WCS) is a crucial oil price index in Western Canada, playing a significant role in determining the price received by Canadian oil producers. As the primary benchmark for heavy crude oil produced in Western Canada, WCS is essential for understanding the dynamics of the oil market in the region. In this article, we will delve into the intricacies of WCS oil price, comparing it to other benchmarks such as West Texas Intermediate (WTI), examining the current WCS closing price, analyzing the WCS oil price forecast, and exploring the implications for the Canadian oil industry.

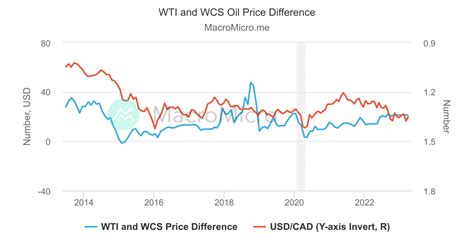

WCS vs. WTI Price Chart:

One of the key comparisons in the oil market is between WCS and WTI, which is the benchmark for light sweet crude oil in the United States. The price differential between WCS and WTI can vary significantly due to factors such as quality, transportation costs, and supply-demand dynamics. A comparison of the WCS vs. WTI price chart can provide insights into the relative performance of these two benchmarks and their impact on the North American oil market.

WCS Closing Price Today:

The daily closing price of WCS is a crucial indicator of the current market sentiment and can influence trading decisions by oil producers, traders, and investors. Tracking the WCS closing price today allows market participants to stay informed about the latest developments in the oil market and make informed decisions based on real-time data.

WCS Oil Price Today:

In addition to the closing price, monitoring the WCS oil price throughout the trading day provides a comprehensive view of the market dynamics and price fluctuations. Factors such as geopolitical events, economic data releases, and supply disruptions can all impact the WCS oil price today, making it essential for market participants to stay informed and react swiftly to changing market conditions.

WCS Oil Price Chart:

Analyzing historical WCS oil price charts can offer valuable insights into long-term trends, price volatility, and key turning points in the market. By studying the patterns and movements in the WCS oil price chart, market participants can identify potential opportunities for trading or investment decisions and develop a better understanding of the factors driving the oil market in Western Canada.

Canadian Crude Oil Price Chart:

In addition to WCS, there are other crude oil benchmarks in Canada, such as Edmonton Par and Western Canadian Select Blend. Comparing these benchmarks through a Canadian crude oil price chart provides a comprehensive overview of the Canadian oil market and the relative performance of different grades of crude oil produced in the country.

WCS Oil Price Forecast:

Forecasting the future direction of the WCS oil price is essential for oil producers, traders, and investors looking to make informed decisions about their positions in the market. Factors such as production levels, pipeline capacity, global demand, and geopolitical risks all play a role in shaping the WCS oil price forecast, making it a complex and dynamic process.

wcs oil price $123.00

wcs oil price - wcs oil price forecast